Consider the following to answer the question(s) below:

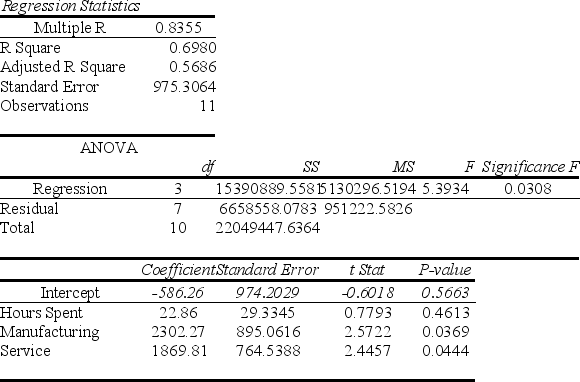

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

-If the number of hours spent on a client is 100, and the client is in the Service industry,what is the predicted net profit?

Definitions:

Capital Maintenance

A company's ability to maintain the level of its capital after covering its expenses, ensuring that its financial health and capacity to generate shareholder value are preserved.

Net Assets

This term refers to the total value of assets minus the total value of liabilities.

New Capital

Funds obtained by a company to finance its operations, expansion, or other projects, which can come from debt or equity sources.

Historical Cost

The original monetary value of an asset or transaction, based on the amount paid or the value at the time it was acquired.

Q4: Explain the priority of law in the

Q9: Data were collected for a sample of

Q10: If the accord is performed, it is

Q12: According to the maximax approach, the investor

Q13: A particular additive is claimed to increase

Q13: For a more accurate determination, top management

Q15: Which of the following is not an

Q16: The slope of the estimated regression line

Q25: Below is a plot showing residuals versus

Q70: A human resources manager at a large