Consider the following to answer the question(s) :

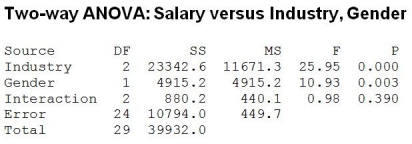

An advocacy group is interested in determining if gender (1 = Female, 2 = Male) affects executive level salaries. They take a random sample of executives in three different industries: (1 = Consumer Goods, 2 = Financial, 3 = Health Care) . Salary data are collected. The two-way ANOVA results appear below.

-At α = 0.05, we can conclude

Definitions:

Taxable Income

The portion of an individual or company's income used to determine how much tax is owed to the government in a given tax year.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities. Tax rates vary based on income levels and types of filers.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, typically aimed at ensuring higher earners pay a larger percentage of their income in taxes.

Regressive Tax

A tax imposed in such a way that the tax rate decreases as the amount subject to taxation increases, burdening lower-income individuals relatively more than higher-income ones.

Q6: For more accurate cost determination, ABI Insurance

Q8: Which statement about residuals plot is true?<br>I.

Q8: The following scatterplot shows a relationship between

Q15: The human resources department at Bell Canada

Q16: City officials want to estimate the proportion

Q22: Annual estimates of the population in the

Q23: Write a sentence or two about the

Q33: The correct value of the test statistic

Q36: The correct null and alternative hypotheses are<br>A)

Q127: Harwichport Company has a current ratio of