Consider the following to answer the question(s) below:

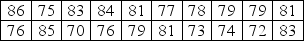

Insurance companies track life expectancy information to assist in determining the cost of life insurance policies. Last year the average life expectancy of all policyholders was 77 years. ABI Insurance wants to determine if their clients now have a longer life expectancy, on average, so they randomly sample some of their recently paid policies. The insurance company will only change their premium structure if there is evidence that people who buy their policies are living longer than before. The sample has a mean of 78.6 years and a standard deviation of 4.48 years.

-At α = 0.05

Definitions:

Effective Yield

A measure of the return on an investment taking into account the effect of compounding interest, more accurate than simple yield calculations.

Present Value Factors

Multipliers used in calculating the present value of a future amount of money or stream of cash flows given a specified rate of return or discount rate.

Floating-rate Debt

Debt instruments, such as bonds or loans, that have variable interest rates that adjust over the tenure of the obligation.

Market Interest Rate

The prevailing rate at which interest is offered on deposits or loans in the financial markets for a particular term and risk profile.

Q8: What affects flat panel LCD TV sales?

Q11: The Consumer Reports Health study on arthritis

Q14: The forecasting method that will most likely

Q15: If the group is risk averse, they

Q19: What is the correct estimate of σ?<br>A)

Q21: All regular ASW customers is known as

Q21: Using the maximax approach, the investor should<br>A)

Q25: All else being equal, increasing the level

Q27: A contingency table is used to display<br>A)

Q37: Which assumption appears to be violated?<br>A) Linearity<br>B)