Consider the following to answer the question(s) below:

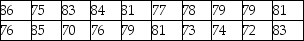

Insurance companies track life expectancy information to assist in determining the cost of life insurance policies. Last year the average life expectancy of all policyholders was 77 years. ABI Insurance wants to determine if their clients now have a longer life expectancy, on average, so they randomly sample some of their recently paid policies. The insurance company will only change their premium structure if there is evidence that people who buy their policies are living longer than before. The sample has a mean of 78.6 years and a standard deviation of 4.48 years.

-Write the null and alternative hypotheses.

Definitions:

Price of Capital

The cost of using capital, which can include the interest rate on loans or the rate of return required by investors on their investment in a company.

Units of Output

The quantity or number of items produced by a company, individual, or production process.

Fixed Cost

Costs that do not vary with the volume of output produced, such as rent, salaries, or loan payments.

Mortgage Payments

Regular payments made to repay a loan taken out to purchase property, typically consisting of both principal and interest components.

Q5: An Internet service provider has the capability

Q6: Based on the F-statistic and associated P-value,

Q9: Here is the side-by-side bar chart for

Q10: Suppose that the mean income of people

Q10: The table below shows the actual closing

Q12: The appropriate null and alternative hypotheses are<br>A)

Q13: The minimin choice strategy is<br>A) the action

Q20: At α = 0.05<br>A) We fail to

Q21: If we were interested in predicting the

Q23: Recently a shipping company took 30 samples