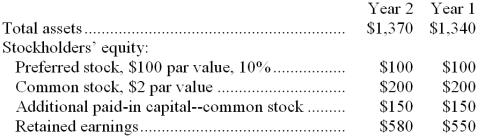

Tedder Corporation has provided the following financial data (in thousands of dollars):

Net income for Year 2 was $80 thousand. Interest expense was $16 thousand. The tax rate was 30%. Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $6.79 per share.

Required:

Compute the following for Year 2:

a. Earnings per share (of common stock).

b. Price-earnings ratio.

c. Dividend payout ratio.

d. Dividend yield ratio.

e. Return on total assets.

f. Return on common stockholders' equity.

g. Book value per share.

Definitions:

Drug Rehabilitation

The process of medical or psychotherapeutic treatment for dependency on psychoactive substances like alcohol, prescription drugs, and street drugs.

Medical Savings Accounts

Tax-advantaged accounts purposed for medical expenses, encouraging savings for future healthcare needs.

Catastrophic Health Insurance

A type of health insurance plan that provides coverage for emergencies and serious health conditions, often with higher deductibles and lower premiums.

Medical Savings Accounts

Savings accounts designed for individuals to save for medical expenses tax-free, often associated with high-deductible health plans.

Q4: What is the "Who" in the Consumer

Q15: A consumer research group investigating the relationship

Q17: The return on common stockholders' equity for

Q18: Shown below is a correlation table showing

Q20: Which of the following statements is true?<br>A)

Q28: The IQR for these data is<br>A) $83,060<br>B)

Q38: (Ignore income taxes in this problem.) Sue

Q83: The average sale period for Year 2

Q117: Bracken Company's net income last year was

Q187: Lisa Inc.'s return on common stockholders' equity