NOTES TO THE INSTRUCTOR:

* The problem requirement does not indicate whether the indirect or direct method must be used to determine the net cash provided by operating activities. You can, if you choose, specify that either (or even both) methods be used. The solution contains solutions for both methods.

* Due to the length of the problem, you may want to eliminate one or more of the requirements.

-----------------------

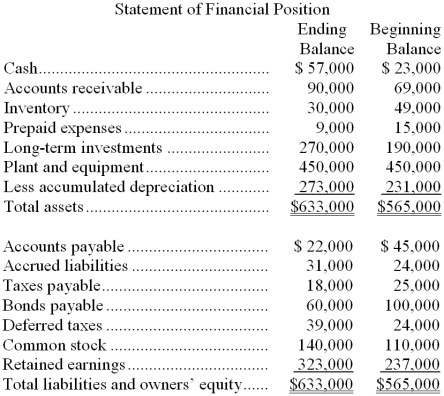

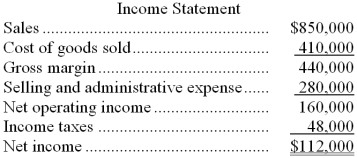

Davis Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $26,000 in cash dividends during the year.

Required:

a. Construct the operating activities section of the company's statement of cash flows for the year.

b. Construct the investing activities section of the company's statement of cash flows for the year.

c. Construct the financing activities section of the company's statement of cash flows for the year.

Definitions:

FIFO

First-In, First-Out, an inventory method where the oldest items in stock are sold first.

LIFO

Last-In, First-Out, an inventory valuation method where the most recently produced or purchased items are sold first, used for cost of goods sold calculation.

Pretax Income

The amount of income earned by a business before taxes have been deducted.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Q1: The percentage of clients who are over

Q24: The probability that a client is holding

Q31: Ignoring any salvage value, to the nearest

Q34: The capital budgeting method that divides a

Q46: (Ignore income taxes in this problem.) Dilworth

Q63: Policastro Corporation produces two intermediate products, A

Q81: Based solely on the information above, the

Q183: The Miller Company paid off some of

Q196: Larkins Company's price-earnings ratio on December 31,

Q199: The debt-to-equity ratio at the end of