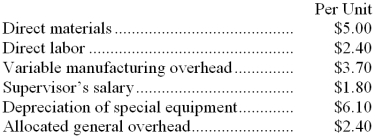

Outram Corporation is presently making part I14 that is used in one of its products. A total of 8,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:

An outside supplier has offered to make and sell the part to the company for $14.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. If management decides to buy part I14 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

Definitions:

Null Hypothesis

A statistical hypothesis that suggests there is no significant difference between specified populations, any observed difference being due to sampling or experimental error.

P-Value

In statistical hypothesis testing, the probability of obtaining test results at least as extreme as the ones observed during the study, assuming that the null hypothesis is true.

Null Hypothesis

A default position that there is no difference or effect, in statistics, until evidence suggests otherwise.

Traffic Data

Information collected about the movement of vehicles on roads used to analyze flow patterns, congestion, and planning transportation systems.

Q3: A planning budget is prepared before the

Q15: The standards that allow for no machine

Q19: The net cash provided by (used by)

Q20: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3790/.jpg" alt="Given

Q24: The payback period for the investment is:<br>A)

Q72: (Ignore income taxes in this problem.) Parks

Q73: (Ignore income taxes in this problem.) The

Q86: (Ignore income taxes in this problem.) Joe

Q91: Positive free cash flow suggests that the

Q173: Authement Corporation has provided the following data