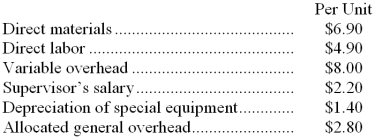

Kleffman Corporation is presently making part X31 that is used in one of its products. A total of 2,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

-In addition to the facts given above, assume that the space used to produce part X31 could be used to make more of one of the company's other products, generating an additional segment margin of $23,000 per year for that product. What would be the impact on the company's overall net operating income of buying part X31 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Economic Profits

The profit a firm makes after deducting both its explicit and implicit costs, reflecting the total opportunity costs of all resources used.

Yearly Return

The total gain or loss on an investment over a one-year period, expressed as a percentage of the investment's initial value.

Variable Costs

Expenditures that adjust in relation to the level of production.

Fixed Costs

Costs that do not vary with the level of output produced by a firm, such as rent, salaries, and insurance premiums.

Q7: (Ignore income taxes in this problem.) The

Q35: Huger Corporation makes automotive engines. For the

Q42: The following data have been provided by

Q47: The Northern Division of the Smith Company

Q47: Mcgann Corporation is developing standards for its

Q53: The present value of all future operating

Q71: The general model for calculating a quantity

Q100: The revenue variance for August would be

Q104: Part F77 is used in one of

Q154: Rahner Company has a current ratio of