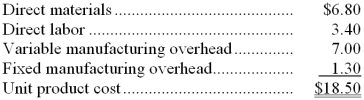

A customer has requested that Daleske Corporation fill a special order for 2,000 units of product D84 for $20.30 a unit. While the product would be modified slightly for the special order, product D84's normal unit product cost is $18.50:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product D84 that would increase the variable costs by $2.50 per unit and that would require an investment of $7,000 in special molds that would have no salvage value.

This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Definitions:

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to taxation.

Vertical Equity

A principle of fairness in taxation that dictates taxpayers with a greater ability to pay should contribute more in taxes.

Cardio-Vascular Diseases

A class of diseases that involve the heart or blood vessels, including coronary artery disease, hypertension, and stroke.

Fried Foods Tax

A hypothetical or proposed tax imposed on products with high levels of fried content to discourage consumption and address health concerns.

Q41: Arlon Jeffries Candy Corporation produces and sells

Q41: Outram Corporation is presently making part I14

Q43: The net cash provided by (used by)

Q59: The net cash provided by (used by)

Q86: The average collection period for Year 2

Q136: The working capital at the end of

Q171: Which of the following would cause a

Q176: The manufacturing overhead in the flexible budget

Q193: Kimbril Catering uses two measures of activity,

Q215: The selling and administrative expenses in the