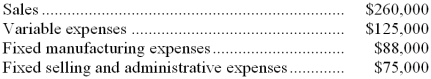

The management of Zorrilla Corporation is considering dropping product R10C. Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $42,000 of the fixed manufacturing expenses and $48,000 of the fixed selling and administrative expenses are avoidable if product R10C is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $42,000 of the fixed manufacturing expenses and $48,000 of the fixed selling and administrative expenses are avoidable if product R10C is discontinued.

-What would be the effect on the company's overall net operating income if product R10C were dropped?

Definitions:

Times Interest Earned

A financial ratio that measures the ability of a business to meet its interest payments based on current earnings.

Interest Expense

The cost incurred by a company for borrowed funds, including loans, bonds, and lines of credit.

Times Interest Earned Ratio

A metric to assess a company's ability to meet its debt obligations, calculated as earnings before interest and taxes divided by interest expense.

Times Interest Earned

A financial ratio measuring a company's ability to meet its interest obligations from operating earnings, calculated as income before interest and taxes divided by interest expense.

Q11: The net present value of the proposed

Q11: The selling and administrative expenses in the

Q28: Grboyan Corporation's most recent balance sheet appears

Q49: The net present value of the investment

Q64: The present value of the annual cost

Q65: Which of the following would be considered

Q101: Hanemann Corporation's most recent balance sheet appears

Q103: Rank the projects according to the profitability

Q106: The standard direct labor rate should not

Q120: The activity variance for net operating income