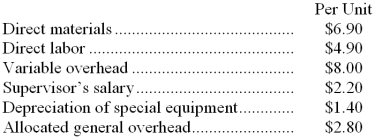

Kleffman Corporation is presently making part X31 that is used in one of its products. A total of 2,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

-In addition to the facts given above, assume that the space used to produce part X31 could be used to make more of one of the company's other products, generating an additional segment margin of $23,000 per year for that product. What would be the impact on the company's overall net operating income of buying part X31 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Standard Costs

The preset costs for delivering a product or service under normal conditions.

Pounds

Pounds refer to a unit of mass used in the imperial system, or can also refer to the British currency (GBP).

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and are a significant portion of the product's cost.

Selling and Administrative Expenses

Costs related to selling a product and managing a business, excluding direct production costs.

Q20: Kissack Corporation produces large commercial doors for

Q20: An automated turning machine is the current

Q36: (Ignore income taxes in this problem.) Prince

Q41: Idso Industries is a division of a

Q46: Which product makes the LEAST profitable use

Q62: A static planning budget is suitable for

Q78: Spiro Corporation's comparative balance sheet appears below:

Q101: Hanemann Corporation's most recent balance sheet appears

Q115: (Ignore income taxes in this problem.) The

Q210: The total variable cost at the activity