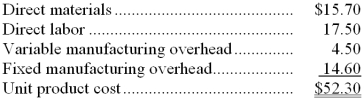

Fouch Company makes 30,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $51.90 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $219,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a. How much of the unit product cost of $52.30 is relevant in the decision of whether to make or buy the part?

b. What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 30,000 units required each year?

Definitions:

Merchandise Trade Balance

The difference between a country's exports and imports of tangible goods.

Services Trade Balance

The difference between exports and imports of services of a country, reflecting whether a country is a net provider or consumer of services internationally.

Adam Smith

An 18th-century economist known as the father of modern economics, famous for his theories on free markets and the 'invisible hand'.

International Trade

The exchange of goods and services across international boundaries.

Q19: The spending variance for expendables in February

Q25: Rank the products in order of their

Q36: The division's turnover is closest to:<br>A) 32.26<br>B)

Q56: Kerson Corporation's most recent balance sheet and

Q66: A flexible budget:<br>A) classifies budget requests by

Q80: (Ignore income taxes in this problem.) Tighe

Q83: The activity variance for wages and salaries

Q86: (Ignore income taxes in this problem.) Joe

Q186: Trusillo Corporation's net operating income last year

Q249: The activity variance for selling and administrative