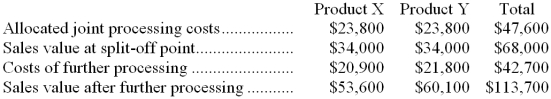

Iacollia Company makes two products from a common input. Joint processing costs up to the split-off point total $47,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:

a. What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

b. What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Gasoline Demand

The total quantity of gasoline that consumers are willing and able to purchase at a given price over a certain period.

Price Elasticity

A measure of how the quantity demanded or supplied of a good changes in response to a change in its price.

Gasoline Demand

Gasoline demand refers to the quantity of gasoline that consumers are willing and able to purchase at various prices during a certain period of time.

Quantity Demanded

The amount of a good that buyers are willing and able to purchase at a specific price.

Q2: Consider the following statements:<br>I. A vertically integrated

Q8: Anspach Corporation has two divisions: the Governmental

Q41: Outram Corporation is presently making part I14

Q43: (Ignore income taxes in this problem.) A

Q45: The manufacturing overhead in the flexible budget

Q54: (Ignore income taxes in this problem.) The

Q63: Policastro Corporation produces two intermediate products, A

Q100: What is Reenu's labor efficiency variance for

Q201: The acid-test ratio at the end of

Q227: The selling and administrative expenses in the