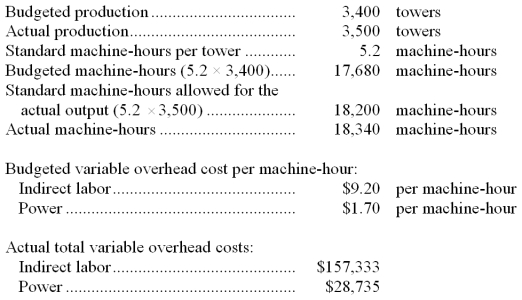

Osier Corporation, which produces cellular transmission towers, has provided the following data:

-The variable overhead efficiency variance for power is:

Definitions:

CAPM

The Capital Asset Pricing Model is a conceptual model employed to calculate the anticipated return on an investment, taking into account both the risk associated with the investment and the time value of money.

Market Portfolio

A theoretical portfolio that includes all assets available in the market, each weighted by its market capitalization, often used in the Capital Asset Pricing Model (CAPM).

SML Relationship

The Security Market Line relationship, which represents the expected return of a security or portfolio in relation to its beta, or market risk.

Multifactor CAPM

An extension of the Capital Asset Pricing Model (CAPM) that incorporates multiple factors in the assessment of risk and expected return of an asset, beyond just the market risk.

Q11: According to the company's accounting system, what

Q30: Testing a prototype of a new product

Q66: A flexible budget:<br>A) classifies budget requests by

Q78: The profitability index of investment project J

Q81: The net present value of the project

Q93: The division's return on investment (ROI) is

Q107: The net present value of the proposed

Q142: If the budgeted direct labor time for

Q148: The manufacturing overhead in the flexible budget

Q149: The spending variance for direct materials in