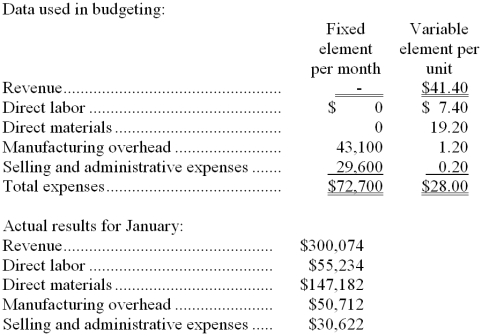

Woofter Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During January, the company budgeted for 7,600 units, but its actual level of activity was 7,560 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for January:

-The net operating income in the planning budget for January would be closest to:

Definitions:

Budgeted Overhead Cost

An estimate of the total indirect costs or overheads expected to be incurred during a specified budget period.

Activity Rates

Charges or costs associated with specific business activities, used in costing and budgeting.

Activity Levels

Various stages of business operations ranging from high to low, impacting costs and revenues.

Activity-Based Costing (ABC)

A costing method that assigns overhead and indirect costs to related products and services based on the activities that drive those costs.

Q10: The medical supplies in the flexible budget

Q39: Mafli Company, which has only one product,

Q46: Thiel Inc. is working on its cash

Q68: Kaighn Corporation has two divisions: the West

Q78: The following labor standards have been established

Q78: The activity variance for wages and salaries

Q117: In the selling and administrative budget, the

Q126: Friden Company has budgeted sales and production

Q144: Lido Company's standard and actual costs per

Q200: Squillace Corporation uses customers served as its