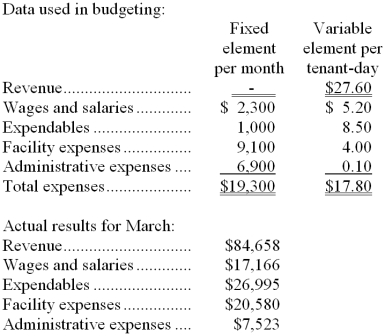

Swader Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 2,900 tenant-days, but its actual level of activity was 2,930 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March:

-The net operating income in the flexible budget for March would be closest to:

Definitions:

Cumulative Preferred Stock

A type of preferred stock that entitles shareholders to receive dividends in arrears before common stockholders can be paid dividends.

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation and a claim on part of the corporation's profits or losses.

Dividends Per Share

Dividends per share is a measure reflecting the amount of declared dividends for each share of common stock, revealing how much a company pays out in dividends relative to its share price.

Fiscal Year

A one-year period selected for accounting purposes, which does not necessarily correspond to the calendar year.

Q2: The variable overhead efficiency variance measures how

Q17: Assuming that the company charges $458.08 for

Q20: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3790/.jpg" alt="Given

Q24: Ries Corporation has received a request for

Q34: Gladstone Footwear Corporation's flexible budget cost formula

Q48: What is the net operating income for

Q54: Which of the intermediate products should be

Q68: Last year, Brunkow Corporation's variable costing net

Q120: The throughput time was:<br>A) 4.3 hours<br>B) 31.6

Q208: Ruvolo Jeep Tours operates jeep tours in