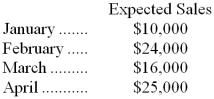

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-The Accounts Receivable balance that would appear in the March 31 budgeted balance sheet would be:

Definitions:

Subsidies

Financial contributions by a government or public body to support businesses, consumers, or economic sectors, reducing the price of goods and services or the cost of production.

Economic Integration

Occurs when two or more nations join to form a free-trade zone.

Free-Trade Zone

A specific area within a country where goods may be imported, handled, manufactured, or reconfigured without direct intervention by the customs authorities, often to encourage trade and investment.

Acquired Comparative Advantage

An advantage gained by a country or firm through learning, innovation, and investment, as opposed to natural endowments.

Q27: If the budgeted production for July is

Q39: Data concerning three of the activity cost

Q39: The spending variance for power costs in

Q51: The activity variance for direct labor in

Q54: Last year, Wardrup Corporation's variable costing net

Q101: Duell Clinic uses patient-visits as its measure

Q135: What is the total period cost for

Q151: Which of the following is true regarding

Q178: If the company sells 8,300 units, its

Q182: Faggs Corporation bases its budgets on the