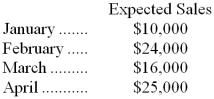

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a cash budget for March, the total cash receipts would be:

Definitions:

Allocative Efficiency

A scenario in resource distribution where making one individual's condition better inevitably leads to worsening another's.

Economic Profit

The difference between a firm's total revenues and its total economic costs, including both explicit and implicit costs.

Diagram (A)

A graphical representation or chart designed to illustrate or explain concepts, processes, or data.

Allocative Inefficiency

A situation in which resources are not distributed optimally among producers or consumers, leading to a loss in economic efficiency.

Q9: The cash balance at the end of

Q10: How much indirect factory wages and factory

Q15: The standards that allow for no machine

Q58: Vodopich Corporation has provided the following data

Q66: Ben Company produces a single product. Last

Q89: A self-imposed budget can be a very

Q95: Eisner Tech is a for-profit vocational school.

Q112: ABC Company has a cash balance of

Q160: Cahalane Natural Dying Corporation measures its activity

Q216: The activity variance for plane operating costs