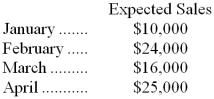

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-The Accounts Receivable balance that would appear in the March 31 budgeted balance sheet would be:

Definitions:

Equilibrium Quantity

The quantity of goods or services supplied equals the quantity demanded at the market equilibrium price.

Supply Curve

A graphical representation showing the relationship between the price of a good or service and the amount of it that producers are willing and able to supply at various prices.

Increase In Supply

A situation where the quantity of a good that producers are willing and able to sell at a particular price rises.

Quantity Supplied

In economics, refers to the total amount of goods or services that producers are willing and able to sell at a given price within a specific time period.

Q35: Roufs Inc. bases its selling and administrative

Q36: The unit product cost under variable costing

Q59: The company's margin of safety as a

Q67: In activity-based costing, organization-sustaining costs should not

Q76: The standard quantity in kilograms of this

Q129: Net operating income computed using variable costing

Q170: The activity variance for net operating income

Q172: The activity variance for selling and administrative

Q217: Posson Catering uses two measures of activity,

Q244: Elizarraras Air uses two measures of activity,