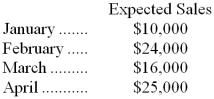

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a cash budget for March, the total cash receipts would be:

Definitions:

Plowback Ratio

The proportion of earnings retained by a business, rather than distributed to its shareholders as dividends, to reinvest in the core business or to pay debt.

Dividend Policy Decision

The strategy that a company uses to determine the size and timing of its dividends payments to shareholders.

Capital Intensity Ratio

A financial metric that measures the amount of capital needed per dollar of revenue; used to evaluate the investment intensity of a business's operations.

Fixed Asset Turnover Ratio

A financial metric that measures how efficiently a company uses its fixed assets to generate sales, calculated by dividing net sales by average fixed assets.

Q14: The administrative expenses in the planning budget

Q32: Yoshihara Corporation produces a single product and

Q48: The direct labor in the planning budget

Q57: The Fletcher Company uses standard costing. The

Q62: A static planning budget is suitable for

Q68: Whiting Corporation has provided the following data

Q110: Hutton Corporation keeps careful track of the

Q118: Payment Inc. is preparing its cash budget

Q169: Similien Corporation produces and sells a single

Q178: If the company sells 8,300 units, its