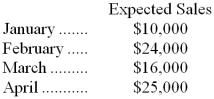

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a cash budget for March, the total cash disbursements would be:

Definitions:

Cultural Competence

The ability to understand, appreciate, and interact effectively with people from cultures or belief systems different from one’s own.

Emotional Engagement

The emotional connection a brand creates with its audience, influencing loyalty and long-term customer relationships.

Self-Identification

The process by which an individual defines or categorizes themselves according to their own perception of gender, race, beliefs, or affiliation.

Auxiliary Consumption

The additional expenditure on goods or services that accompanies the use or consumption of a primary product.

Q30: The spending variance for medical supplies in

Q71: A production budget is to a manufacturing

Q73: The unit product cost under variable costing

Q108: The materials quantity variance is:<br>A) $400 U<br>B)

Q112: ABC Company has a cash balance of

Q150: The activity variance for direct labor in

Q156: Magers Corporation produces and sells a single

Q167: If the selling price is reduced by

Q182: Faggs Corporation bases its budgets on the

Q265: The activity variance for administrative expenses in