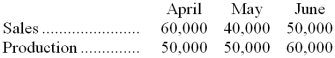

Carter Company has projected sales and production in units for the second quarter of next year as follows:

Required:

a. Cash production costs are budgeted at $6 per unit produced. Of these production costs, 40% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses (all of which are paid in cash) amount to $120,000 per month. The accounts payable balance on March 31 totals $192,000, all of which will be paid in April. Prepare a schedule for each month showing budgeted cash disbursements for Carter Company.

b. Assume that all units will be sold on account for $15 each. Cash collections from sales are budgeted at 60% in the month of sale, 30% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on March 31 totaled $510,000 $(90,000 from February's sales and the remainder from March). Prepare a schedule for each month showing budgeted cash receipts for Carter Company.

Definitions:

Q12: When sales exceeds production for a period,

Q22: The variable overhead rate variance for supplies

Q33: Loehr Corporation's management reports that its average

Q61: Mcferrin Corporation manufactures a variety of products.

Q63: Assuming that actual activity turns out to

Q103: Gasco Clinic uses patient-visits as its measure

Q113: The linear equation Y = a +

Q119: The variable overhead rate variance for lubricants

Q134: Accounts payable at the end of December

Q155: Naval Catering uses two measures of activity,