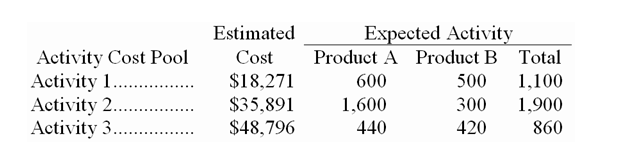

Accola Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 1,100 units and of Product B is 700 units. There are three activity cost pools, with estimated costs and expected activity as follows:

-The activity rate for Activity 3 is closest to:

Definitions:

Child and Dependent Care Expense Credit

A tax credit offered to taxpayers to offset costs for the care of children or dependents, to allow them to work or look for work.

Maximum Amount of Expenses

The highest allowable sum that can be counted as an expense for tax or budgetary purposes.

Joint Returns

A combined tax return filed by legally married couples who choose to report their incomes, exemptions, and deductions on the same tax return.

American Opportunity Tax Credit

A financial credit for approved higher education expenses incurred for an eligible learner within the first four years of their tertiary education.

Q24: A manufacturing company that produces a single

Q32: Electrical costs at one of Gotch Corporation's

Q44: The following information was collected for one

Q58: The unit product cost under absorption costing

Q67: What is the unit product cost for

Q75: Under variable costing, the unit product cost

Q106: On a CVP graph for a profitable

Q119: Hilty Corporation produces and sells two products.

Q120: Schrick Inc. manufactures a variety of products.

Q279: The net operating income in the flexible