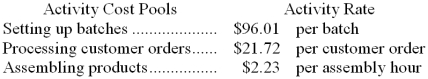

Sailer Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.

Last year, Product J34U involved 48 batches, 22 customer orders, and 395 assembly hours.

Required:

How much overhead cost would be assigned to Product J34U using the company's activity-based costing system? Show your work!

Definitions:

Marginal Tax Rate

The marginal tax rate is the rate at which the last dollar of income is taxed, reflecting the proportion of additional income that is paid in taxes.

Progressive Tax

A tax system where the tax rate increases as the taxable amount or income goes up, making it proportionately higher for wealthier individuals or entities.

Individual Income

The total earnings received by an individual from all sources, including wages, investments, and other forms of compensation.

Marginal Tax Rate

Refers to the rate at which the last dollar of income is taxed, indicating how much tax will be paid on an additional dollar of income.

Q28: The management of Degenhart Corporation, a manufacturing

Q41: The break-even point in dollar sales for

Q48: Given the cost formula Y = $12,000

Q50: Cotillo Corporation uses customers served as its

Q67: The activity variance for administrative expenses in

Q75: How much cost, in total, should NOT

Q90: In the merchandise purchases budget, the required

Q105: The Waverly Company has budgeted sales for

Q131: Clune Clinic bases its budgets on the

Q245: Immen Corporation bases its budgets on the