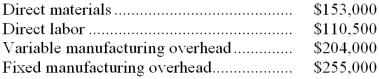

Harris Company produces a single product. Last year, Harris manufactured 17,000 units and sold 13,000 units. Production costs for the year were as follows:  Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing, the carrying value on the balance sheet of the ending inventory for the year would be:

Definitions:

Firm's Shares

Equity securities issued by a company, representing ownership in the firm and entitling holders to dividends and voting rights.

Creditors

People or organizations that provide loans or credit to others with the anticipation of receiving payment back later on.

NPVGO

Net Present Value of Growth Opportunities; a valuation method that calculates the present value of investment opportunities a company is expected to undertake in the future.

Above Average P/E Multiple

A valuation metric indicating that a company's current share price is higher relative to its per-share earnings than the industry or overall market average.

Q36: The wages and salaries in the planning

Q36: The unit product cost under variable costing

Q59: The company's margin of safety as a

Q71: The direct materials in the flexible budget

Q90: The net operating income under absorption costing

Q134: Accounts payable at the end of December

Q160: Moloney Corporation produces and sells a single

Q195: The activity variance for administrative expenses in

Q265: The activity variance for administrative expenses in

Q268: The activity variance for administrative expenses in