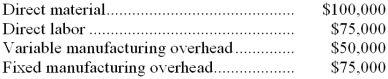

Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows:  Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing, the unit product cost would be:

Definitions:

Internal Pricing System

A method used by companies to assign a price to goods or services exchanged between the different divisions of the same company.

Legal Department

A specialized division within a corporation or organization tasked with handling legal matters and ensuring compliance with laws and regulations.

Joint Costs

Costs that are incurred to produce or acquire two or more products at the same time and cannot be readily identified with the individual products.

Real Estate Taxes

Taxes charged by the government on property ownership, typically based on the property's value.

Q24: The activity variance for net operating income

Q30: Testing a prototype of a new product

Q52: What is the net operating income for

Q56: The total cost transferred from the first

Q79: The administrative expenses in the planning budget

Q84: Weber Company computes net operating income under

Q90: In the merchandise purchases budget, the required

Q105: Which of the following costs at a

Q135: What is the total period cost for

Q193: Ringstaff Corporation produces and sells a single