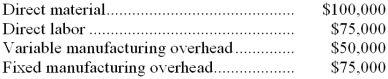

Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows:  Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing, the gross margin would be:

Definitions:

Relevant Market

The market in which a particular product or service competes, considering factors like geography, product substitutability, and consumer preferences.

Market Division

An illegal agreement between competitors to split a market into sections where each party restricts its operations to certain geographic areas or customer segments, to reduce competition.

Heavy Equipment

Refers to large and heavy-duty vehicles designed for construction tasks, most notably earthwork operations.

Wholesale Distributor

A business entity that purchases goods in large quantities from manufacturers and sells them in smaller quantities to retailers or other distributors.

Q1: Mouw Inc. bases its manufacturing overhead budget

Q8: All other things the same, a decrease

Q14: Suoboda Corporation uses the following activity rates

Q88: What is the total period cost for

Q103: Last year, variable expenses were 60% of

Q106: On a CVP graph for a profitable

Q107: The budgeted cash receipts for November are:<br>A)

Q206: In the current year, the company sold

Q266: The spending variance for plane operating costs

Q271: The net operating income in the planning