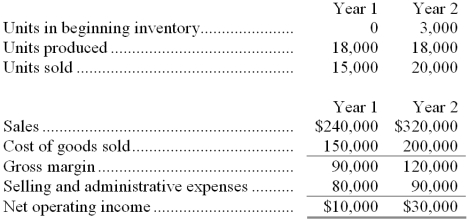

Fowler Company manufactures a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Required:

a. What was the unit product cost in each year under variable costing?

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Cash Flow

The net amount of cash being transferred into and out of a business, which is used to maintain the company's operations.

Operating Activities

Business actions directly related to its day-to-day operations, such as selling products or services, which generate revenue and expenses.

Amortization Expense

The systematic allocation of the cost of an intangible asset over its useful life.

Book Value

The value of an asset according to its balance sheet account balance, which represents the cost of the asset minus any depreciation, amortization, or impairment costs.

Q17: Assuming that the company charges $458.08 for

Q31: Mashore Jeep Tours operates jeep tours in

Q45: The manufacturing overhead in the flexible budget

Q64: What is the unit product cost for

Q65: The direct labor in the planning budget

Q72: A manufacturing company that produces a single

Q92: What would be the total variable inspection

Q114: Speir Corporation's contribution format income statement for

Q161: The selling and administrative expenses in the

Q215: The selling and administrative expenses in the