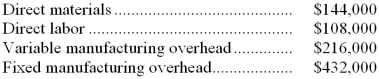

During its first year of operations, Holt Manufacturing Company incurred the following costs to produce 200,000 units of its only product:  Holt also incurred the following costs in the sale of 180,000 units of product during its first year:

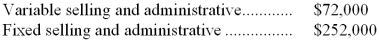

Holt also incurred the following costs in the sale of 180,000 units of product during its first year:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

-What would be the cost per unit of Holt's finished goods inventory at the end of the first year of operations under the absorption costing method?

Definitions:

Net Operating Profit After Taxes (NOPAT)

A company's operating profit after adjusting for taxes, useful for comparing the profitability of businesses.

Weighted Average Cost of Capital

A calculation of a firm's cost of capital in which each category of capital is proportionately weighted, used to assess the cost of funding new projects.

Taxable Income

The portion of an individual's or company's income used to determine how much tax will be owed to the federal, state, and/or municipal governments.

Shareholders

Individuals or entities that own shares in a company, giving them ownership interest.

Q9: The following is last month's contribution format

Q13: Proudfoot Corporation uses the following activity rates

Q19: Raulot Corporation uses the weighted-average method in

Q56: The net operating income in the planning

Q59: The company's margin of safety as a

Q83: The activity variance for wages and salaries

Q88: Tolla Company is estimating the following sales

Q104: When the level of activity increases within

Q132: The total needs (i.e., production requirements plus

Q134: O'Bannion Company, which has only one product,