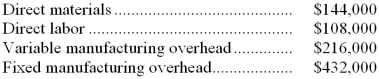

During its first year of operations, Holt Manufacturing Company incurred the following costs to produce 200,000 units of its only product:  Holt also incurred the following costs in the sale of 180,000 units of product during its first year:

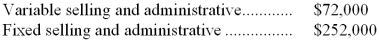

Holt also incurred the following costs in the sale of 180,000 units of product during its first year:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

-If Holt's variable costing net operating income for this first year is $397,800, what would its absorption costing net operating income be for this first year?

Definitions:

Predetermined Rate

A rate established before the start of a project or period, often used in budgeting and costing, to assign overhead costs to specific activities.

First-In, First-Out

An accounting method for valuing inventory which assumes that the first items purchased are the first ones sold.

Direct Labor

Labor costs that are directly tied to the production of goods or the provision of services, such as wages of factory workers.

Factory Overhead

All indirect costs associated with the manufacturing process, including costs related to operating the factory such as utilities, equipment depreciation, and maintenance.

Q3: The controller of JoyCo has requested a

Q6: Expense A is a fixed cost; expense

Q22: If the budgeted direct labor time for

Q24: Assuming that the unit sales are unchanged,

Q26: The cost of goods sold in a

Q37: Rank the following methods of assigning overhead

Q38: Data concerning Enslow Corporation's single product appear

Q41: Process costing would be appropriate for each

Q98: Alarie Tech is a for-profit vocational school.

Q99: A cost formula may not be valid