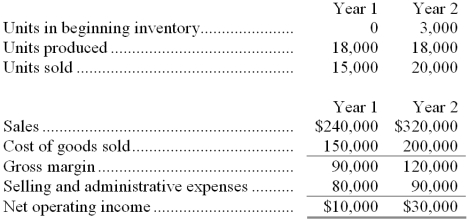

Fowler Company manufactures a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Required:

a. What was the unit product cost in each year under variable costing?

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Semantic Encoding

The process of encoding sensory input that has particular meaning or can be applied to a context, rather than merely being remembered as a visual or auditory stimulus.

Mnemonic

A memory aid, often a word, phrase, or visual image, designed to help remember information or a concept.

Phonemic

Relating to the system of phonemes in a language, that is, the smallest unit of sound that can distinguish meaning.

Structural

Pertaining to the underlying framework or organization of a system.

Q3: To attain its desired ending cash balance

Q12: The company plans to sell 22,000 units

Q51: The activity variance for direct labor in

Q57: A manufacturing company that produces a single

Q85: The labor time ticket contains the details

Q92: What would be the total variable inspection

Q102: In July, one of the processing departments

Q116: The relevant range concept is not applicable

Q119: Hilty Corporation produces and sells two products.

Q152: Salvia Urban Diner is a charity supported