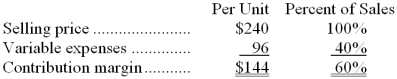

Data concerning Hillegass Corporation's single product appear below:

Fixed expenses are $502,000 per month. The company is currently selling 4,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Definitions:

Working Capital

The distinction between an organization's immediate assets and liabilities, showing its short-term fiscal well-being and effectiveness in operations.

Plant and Equipment

Long-term tangible assets used in the operation of a business, not intended for sale.

Noncurrent Assets

Long-term assets that are not expected to be converted into cash, sold, or consumed within one year or the operating cycle, including property, plant, and equipment.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, representing the ownership interest of shareholders.

Q4: The desired ending inventory for August is:<br>A)

Q9: If the materials handling cost is allocated

Q21: Graney Corporation uses an activity-based costing system

Q43: The margin of safety is equal to:<br>A)

Q49: The overhead for the year was:<br>A) $2,994

Q54: The Cost of Goods Manufactured was:<br>A) $22,900<br>B)

Q67: How many units are in ending work

Q70: Tassone Corporation has provided the following data

Q172: Harist Corporation sold 5,000 units in May.

Q210: Goyal Inc. has an operating leverage of