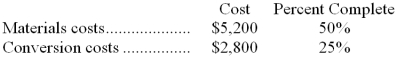

Chabud Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 500 units. The costs and percentage completion of these units in beginning inventory were:  A total of 8,100 units were started and 7,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

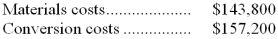

A total of 8,100 units were started and 7,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:  The ending inventory was 70% complete with respect to materials and 40% complete with respect to conversion costs.

The ending inventory was 70% complete with respect to materials and 40% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost per equivalent unit for materials for the month in the first processing department is closest to:

Definitions:

Dividends

Payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders.

Investment

The action of deploying resources (such as capital) with the expectation of generating an income or profit.

Cost Method

is an accounting approach used for recording investments, where the investment is recorded at its acquisition cost and adjustments are made for dividends or interest earned and changes in value are not recognized until sold.

Trading Securities

Trading securities are investments in debt or equity that are purchased with the intention of selling them in the near term to realize short-term gains.

Q4: Uzzle Corporation uses a discount rate of

Q21: The company's net operating income under variable

Q22: If a company is operating at a

Q25: The following cost data relate to the

Q50: The three basic elements of manufacturing cost

Q63: The debits to the Manufacturing Overhead account

Q90: The degree of operating leverage is closest

Q93: The following costs were incurred in August:

Q141: The corporate controller's salary would be considered

Q162: A product sells for $20 per unit,