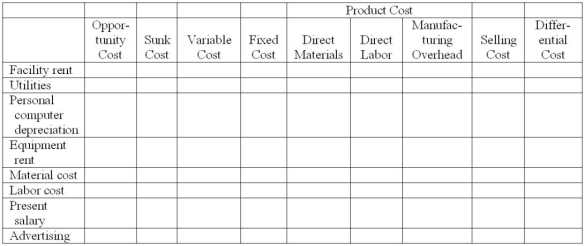

Sid Freeman has developed a new electronic device that he has decided to produce and market. The production facility will be in a nearby industrial park which Sid will rent for $4,000 per month. Utilities will cost about $500 per month. He will use his personal computer, which he purchased for $2,000 last year, to monitor the production process. The computer will become obsolete before it wears out from use. The computer will be depreciated at the rate of $1,000 per year. He will rent production equipment at a monthly cost of $8,000. Sid estimates the material cost per finished unit of product to be $50, and the labor cost to be $10. He will hire workers, and spend his time promoting the product. To do this he will quit his job which pays $4,500 per month. Advertising will cost $2,000 per month. Sid will not draw a salary from the new company until it gets well established.

Required:

Complete the chart below by placing an "X" under each heading that helps to identify the cost involved. There can be "Xs" placed under more than one heading for a single cost; e.g., a cost might be a sunk cost, an overhead cost, and a product cost. There would be an "X" placed under each of these headings opposite the cost.

*Between the alternatives of producing and not producing the device.

Definitions:

Golden Personality Type

A reference to the Golden test, a personality assessment akin to the Myers-Briggs Type Indicator, or potentially a misnomer for a broadly appealing or harmonious personality type, although not a standardized term in psychology.

Logical Analysis

The process of evaluating arguments, statements, or concepts by applying principles of reasoning and logic, often to solve problems or make decisions.

Understanding and Harmony

A state of mutual comprehension and peaceful coexistence among individuals or groups.

Teenage Brain

A stage of brain development in which people are easily influenced by their environment and more prone to impulsive behavior.

Q3: Tenicheff Corporation uses the FIFO method in

Q5: The Assembly Department started the month with

Q8: Contribution margin is the excess of revenues

Q9: Job 827 was recently completed. The following

Q12: The entry to dispose of the underapplied

Q26: Lisby, Inc., allocates service department costs to

Q26: Machowski Corporation has provided the following partial

Q49: The fixed manufacturing overhead budget variance is

Q56: The total cost transferred from the first

Q108: The most common accounting treatment of underapplied