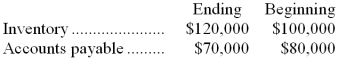

Last year Madson Company reported a cost of goods sold of $800,000 on its income statement. The following additional data were taken from the company's comparative balance sheet for the year:

The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows. The cost of goods sold adjusted to a cash basis would be:

Definitions:

Cost of Goods Sold

The expenses directly tied to the creation of the products sold by a business.

Collections

The process of pursuing payments of debts owed by individuals or businesses, typically involving accounts receivable.

Accounts Receivable

The money owed to a company by its customers for goods or services delivered but not yet paid for.

Credit Sales

Sales made by a business where payment is deferred, allowing the customer to pay at a later date.

Q6: Herne Manufacturing Corporation has a traditional costing

Q8: Division N has asked Division M of

Q10: The amount of direct materials cost in

Q14: For August, the fixed manufacturing overhead volume

Q18: Under the direct method of determining the

Q21: The step-down method requires that an order

Q70: Using the weighted-average method, the cost per

Q79: Mataalii Corporation uses the weighted-average method in

Q92: How much opportunity cost is represented in

Q160: Pricton Corporation has a job-order costing system.