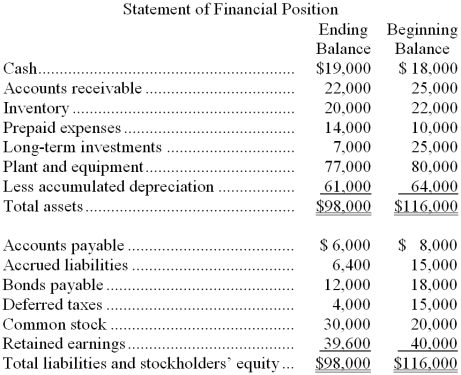

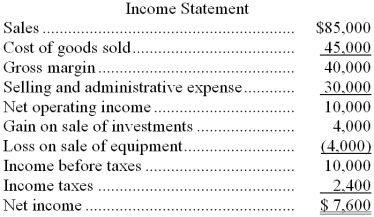

Comparative financial statements for Parr Company follow:

Additional data for the year included:

* During the year, Parr Company sold equipment for $3,000 that had cost $15,000 and on which there was accumulated depreciation of $8,000.

* Equipment was purchased for $12,000 cash.

* Cash dividends totaling $8,000 were paid.

* Long-term investments that cost $18,000 when purchased were sold for $22,000.

* Common stock was issued for $10,000.

* Depreciation expense for the year was $5,000.

Required:

Prepare a statement of cash flows using the direct method.

Definitions:

Civil Dispute

A civil dispute involves a legal disagreement between two or more parties in non-criminal matters, such as disputes over contracts, property, and personal injury.

Regulatory Offences

Violations of rules or regulations that are established by governmental bodies to control or govern conduct in various areas of business and society.

Criminal Law

A branch of law that deals with crimes and their punishments, including the definition of criminal offenses and the imposition of sanctions such as fines and imprisonment.

Cause of Action

A set of facts sufficient to justify the right to sue to obtain money, property, or the enforcement of a right against another party.

Q4: Galli Corporation uses the FIFO method in

Q17: The Sarbanes-Oxley Act of 2002 was intended

Q23: In a plant expansion capital budgeting decision,

Q26: The volume variance for November is:<br>A) $8,760

Q31: Rabin Corporation uses the FIFO method in

Q36: If the denominator level of activity is

Q56: The total cost transferred from the first

Q59: Madtack Company's Cost of Goods Sold for

Q107: The predetermined overhead rate was based on

Q145: If a company applies overhead to jobs