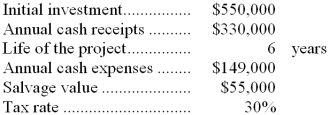

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

Definitions:

Finished Goods Inventory

Products that have completed the manufacturing process and are ready to be sold.

Budgeted Income Statement

A financial statement that projects the income and expenses for a specific period in the future, helping management with planning and decision-making.

Accrued Income Taxes

Accrued income taxes are taxes that a company has incurred but has not yet paid during the reporting period.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decline in value over time.

Q2: If the company bases its predetermined overhead

Q2: A company has a standard cost system

Q5: Using the weighted-average method, the cost per

Q7: Delreal Inc.'s inspection costs are listed below:

Q13: How much actual Order Fulfillment Department cost

Q14: Fauste Corporation uses the weighted-average method in

Q26: Detter Corporation's balance sheet and income statement

Q40: The total Customer solutions Department cost after

Q43: The journal entry to record the incurrence

Q94: The cost per equivalent unit for conversion