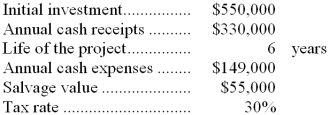

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

Definitions:

Statistic

A numerical value that summarizes or describes a characteristic of a sample of data.

Permutation Test

A nonparametric method to determine statistical significance by computing all possible arrangements of observed data.

Two-Sample T Test

A statistical method used to compare the means of two independent samples to determine if there is a significant difference between them.

P-values

The probability of obtaining an effect at least as extreme as the one in your sample data, assuming the null hypothesis is true, used in hypothesis testing.

Q1: Six Sigma is a process improvement method

Q2: What would be the total prevention cost

Q4: Harville Company's quality cost report is to

Q8: When long-term investment funds are the constraint

Q23: Beauchesne Corporation, a manufacturing company, has provided

Q23: In a plant expansion capital budgeting decision,

Q28: Last year a firm had taxable cash

Q39: Relative profitability should be measured by dividing

Q70: Prime cost consists of direct materials combined

Q97: Jarratt Inc., a manufacturing company, has provided