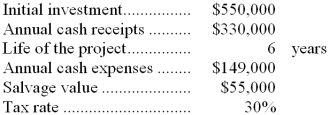

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-The net present value of the project is closest to:

Definitions:

Tax Advantages

Financial benefits derived from tax laws that reduce the amount of tax to be paid by allowing certain deductions, credits, or deferrals.

IRS

The Internal Revenue Service, the United States government agency responsible for tax collection and tax law enforcement.

Signaling Effects

The idea that actions taken by a company, such as dividend payments or changes, can provide information to the market about its future prospects.

Stock Repurchase

A program by which a company buys back its own shares from the marketplace, usually to increase the value of remaining shares.

Q2: Using the following data for August, calculate

Q11: If a cost object such as a

Q13: How much actual Order Fulfillment Department cost

Q58: How many units of product J35V should

Q64: A number of costs and measures of

Q82: Harris Company uses a standard cost system

Q82: The total manufacturing cost for October was:<br>A)

Q110: If the raw materials purchased during April

Q127: The Allen Company uses a job-order costing

Q143: The cost of goods manufactured for January