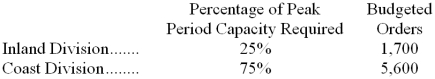

Ocon Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $28 per order. The Customer Service Department's fixed costs are budgeted at $372,300 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.

At the end of the year, actual Customer Service Department variable costs totaled $212,284 and fixed costs totaled $381,740. The Inland Division had a total of 1,710 orders and the Coast Division had a total of 5,560 orders for the year.

Required:

a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Definitions:

Investment Opportunity

A financial venture or asset that offers the potential for profitable returns, through interests, dividends, or capital appreciation.

Company

An organization engaged in commercial, industrial, or professional activities, either as a for-profit or non-profit entity.

Margin

The difference between the selling price of a product or service and its cost, usually expressed as a percentage of the selling price.

Investment Opportunity

A financial asset or situation that is expected to provide a future benefit or return.

Q4: The amount of Maintenance Department cost allocated

Q6: How much actual Logistics Department cost should

Q11: Stamp Printing Corp., a book printer, has

Q12: To record the incurrence of direct labor

Q16: If the company bases its predetermined overhead

Q38: From the standpoint of the entire company,

Q84: If the denominator level of activity is

Q87: The sum of all amounts transferred from

Q95: Manufacturing overhead for the year was:<br>A) $84,000<br>B)

Q125: During May, Sarkin Corporation incurred $69,000 of