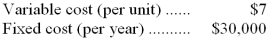

The Buffalo Division of Alfred Products, Inc. has the capacity to manufacture 10,000 units of a certain part each year. This part sells for $12 per unit on the outside market. The Albany Division of Alfred Products, Inc. buys 3,000 units of this part each year from Buffalo, and thus far has paid the market price. Harlow Company (an outside supplier) has recently offered to sell Albany 3,000 units per year of the same part. Buffalo Division's costs relating to the product are:

-Suppose that the Albany Division buys the 3,000 units from the outside supplier at a price of $10 per unit. Also suppose that the Buffalo Division can sell only 6,000 units on the outside market. This decision would have no effect on total fixed costs. As a result of Albany shifting its purchases to the outside supplier, the yearly net operating income of Alfred Products, Inc. as a whole will:

Definitions:

Q4: The manufacturing overhead that would be applied

Q4: Last year Cumley Company reported a cost

Q5: One advantage of using actual cost incurred

Q14: Brabo Corporation uses direct labor-hours in its

Q20: Ocon Corporation has two operating divisions-an Inland

Q40: The Work in Process inventory account of

Q45: Schinkel Corporation has provided the following data

Q90: If the applied manufacturing overhead was $174,000,

Q94: Which of the following situations always results

Q154: Use of a single, plantwide overhead rate