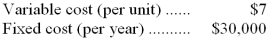

The Buffalo Division of Alfred Products, Inc. has the capacity to manufacture 10,000 units of a certain part each year. This part sells for $12 per unit on the outside market. The Albany Division of Alfred Products, Inc. buys 3,000 units of this part each year from Buffalo, and thus far has paid the market price. Harlow Company (an outside supplier) has recently offered to sell Albany 3,000 units per year of the same part. Buffalo Division's costs relating to the product are:

-Suppose that the Albany Division buys the 3,000 units from the outside supplier at a price of $10 per unit. Also suppose that the Buffalo Division can sell 10,000 units on the outside market. As a result of Albany shifting its purchases to the outside supplier, the yearly net operating income of Alfred Products, Inc. as a whole will:

Definitions:

Judging (J)

A personality trait characterized by a preference for organization, planning, and decision-making in a methodical manner.

Assessment Center

A wide variety of specific selection programs that use multiple selection methods to rate applicants or job incumbents on their management potential.

Multiple Raters

The involvement of several individuals in assessing or evaluating performance, typically to enhance objectivity or reliability.

Evaluators

Professionals who assess or judge the quality, importance, or value of something, such as employee performance.

Q2: The manufacturing overhead applied is:<br>A) $28,000<br>B) $27,000<br>C)

Q6: Becky works 46 hours in a given

Q8: A strategy is a game plan that

Q10: How much Order Fulfillment Department cost should

Q12: The company is considering launching a new

Q31: Lagace Corporation uses the absorption costing approach

Q37: Carver Company's comparative balance sheet and income

Q91: The net operating income for October was:<br>A)

Q93: The following costs were incurred in August:

Q142: The journal entry to record the purchase