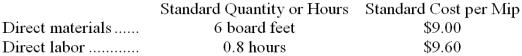

The Dexon Company makes and sells a single product called a Mip and uses a standard costing system. The following standards have been established for one unit of Mip:  There were no inventories of any kind on August 1. During August, the following events occurred:

There were no inventories of any kind on August 1. During August, the following events occurred:

Purchased 15,000 board feet at the total cost of $24,000.

Used 12,000 board feet to produce 2,100 Mips.

Used 1,700 hours of direct labor time at a total cost of $20,060.

-To record the incurrence of direct labor costs and its use in production, the general ledger would include what entry to the Labor Efficiency Variance account?

Definitions:

Link-Chain Method

A statistical method used for adjusting economic or financial time series data for the effects of inflation or other external factors to show real changes over time.

Dollar-Value LIFO

Dollar-value LIFO (Last In, First Out) is an accounting method used for inventory that measures the cost of inventory in dollar terms, adjusting for inflation.

Cost Index

An index that measures the changes in the cost or price of specific goods or services over time.

FIFO Cost

FIFO, or First-In, First-Out, is an inventory valuation method where the costs of the earliest goods purchased or produced are the first to be recognized in determining cost of goods sold.

Q5: Gabris Company's quality cost report is to

Q6: Management is considering purchasing an asset for

Q17: An investment of $180,000 made now will

Q23: The selling price based on the absorption

Q27: The Labor Efficiency Variance for June would

Q27: Brownell Inc. currently has annual cash revenues

Q37: If a product is price inelastic, then

Q43: The journal entry to record the incurrence

Q60: Straus Company, a manufacturer of electronic products,

Q111: Paul Company used a predetermined overhead rate