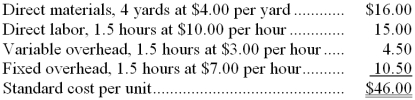

The Moore Company produces and sells a single product. A standard cost card for the product follows:

Standard Cost Card-per unit of product:

The company manufactured and sold 18,000 units of product during the year. A total of 70,200 yards of material was purchased during the year at cost of $4.20 per yard. All of this material was used to manufacture the 18,000 units. The company records showed no beginning or ending inventories for the year.

The company worked 29,250 direct labor-hours during the year at a cost of $9.75 per hour. Overhead cost is applied to products on the basis of standard direct labor-hours. The denominator activity level (direct labor-hours) was 22,500 hours. Budgeted fixed manufacturing overhead costs as shown on the flexible budget were $157,500, while actual fixed manufacturing overhead costs were $156,000. Actual variable overhead costs were $90,000.

Required:

a. Compute the direct materials price and quantity variances for the year.

b. Compute the direct labor rate and efficiency variances for the year.

c. Compute the variable overhead rate and efficiency variances for the year.

d. Compute the fixed manufacturing overhead budget and volume variances for the year.

Definitions:

Investment

The allocation of resources, such as capital or time, in expectation of future returns, typically in the form of income or profit.

Flotation Cost

The total costs incurred by a company in offering new shares of stock, which may include underwriting, legal, and registration fees.

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a dataset, applying a weight to each data point.

Financing

The method by which a business or individual obtains capital to fund their operations or investments.

Q4: A classic mistake made during the implementation

Q5: If the company bases its predetermined overhead

Q5: Using the weighted-average method, the cost per

Q10: Idle time for direct labor factory workers

Q20: Babbel Company is a manufacturing firm that

Q46: The net operating income for December was:<br>A)

Q61: The management of Trachte Corporation is reviewing

Q65: Management has several tools for structuring organization

Q82: Harris Company uses a standard cost system

Q116: Which two terms below describe the wages