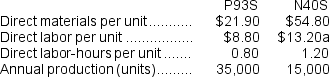

(Appendix 2A) Coudriet Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, P93S and N40S, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

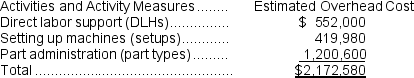

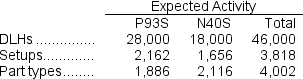

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product P93S under the company's traditional costing system is closest to:

Definitions:

Deadweight Loss

A reduction in economic effectiveness that happens when a good or service does not reach, or cannot reach, its equilibrium state.

Tax Per Unit

Tax per unit is a fixed amount of tax applied to a product or service, regardless of its price, which directly affects the supply curve by increasing production costs.

Tax Levied

The process of imposing a tax by a governing authority on the citizens and organizations.

Buyers And Sellers

Participants in a market where buyers exchange money for goods or services from sellers, creating economic transactions.

Q4: Harville Company's quality cost report is to

Q15: _ is the development of all parts

Q18: What would be the total internal failure

Q19: The fixed costs of service departments should

Q29: In both the direct and step-down methods

Q40: On the statement of cash flows, the

Q42: Which one of the following costs should

Q50: The postimplementation activities performed during the refreeze

Q66: What was the variable overhead rate variance

Q86: The manufacturing costs added to jobs during