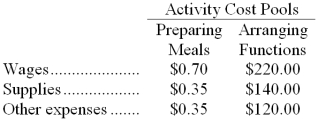

Grodin Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:  The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 180 meals were served. The company catered the function for a fixed price of $15.00 per meal. The cost of the raw ingredients for the meals was $9.65 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost.

-Suppose an action analysis report is prepared for the function mentioned above. What would be the "yellow margin" in the action analysis report? (Round to the nearest whole dollar.)

Definitions:

Nonmonetary Assets

Assets that cannot be readily converted into cash, such as property, equipment, and patents.

Successful-efforts Method

An accounting method used in the oil and gas industry focusing on capitalizing the cost of successful projects and expensing those of unsuccessful ones.

Full-cost Method

An accounting method where all direct and indirect costs of producing an asset are capitalized or included in its cost base.

Drilling Expense

Costs associated with the process of drilling, such as those incurred in the exploration and production of oil and gas resources.

Q2: The accountant of Ronier, Inc., has prepared

Q9: (Ignore income taxes in this problem.) Noe

Q11: The net operating income for April was:<br>A)

Q13: The amount of accounting department costs allocated

Q22: Mahan, Inc., uses the absorption costing approach

Q25: Which of the following would decrease the

Q44: Up to how much should the company

Q48: The total cost transferred from the first

Q73: How much overhead was applied to products

Q84: The cost of fire insurance for a