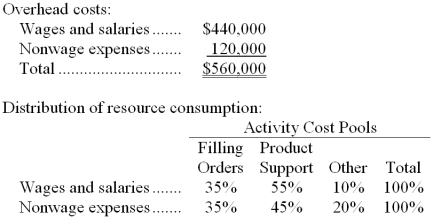

Goha Company, a wholesale distributor, uses activity-based costing for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

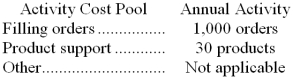

The amount of activity for the year is as follows:

Required:

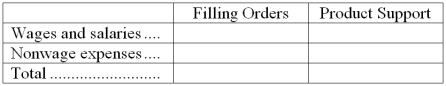

Compute the activity rates (i.e., cost per unit of activity) for the Filling Orders and Product Support activity cost pools by filling in the table below:

Definitions:

Contract Modification

Any change or alteration to the terms of a contract agreed upon by all parties involved.

Consideration

A legal concept referring to something of value given by both parties to a contract that induces them to enter into the agreement to exchange mutual performances.

Mirror-Image Rule

The principle that holds that the terms of the acceptance must mirror the terms of the offer; if the terms of the acceptance do not mirror the terms of the offer, no contract is formed, and the attempted acceptance is a counteroffer.

Mixed Sale

A contract that combines a good with a service or real estate.

Q7: Postimplementation activities include _.<br>A) project assessment<br>B) system

Q17: What would be the total internal failure

Q23: Using the FIFO method, the equivalent units

Q25: When the actual wage rate paid to

Q28: Last year a firm had taxable cash

Q30: What are the equivalent units for materials

Q37: If a product is price inelastic, then

Q71: Kiefert Corporation has provided the following data

Q75: The cost of goods manufactured for July

Q81: There are three key roles in any