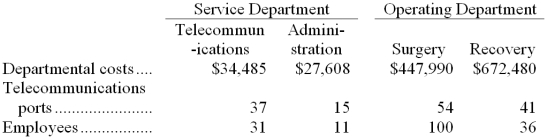

Kormos Surgical Hospital uses the direct method to allocate service department costs to operating departments. The hospital has two service departments, Telecommunications and Administration, and two operating departments, Surgery and Recovery.

Telecommunications Department costs are allocated on the basis of the number of telecommunications ports in departments and Administration Department costs are allocated on the basis of employees. The total Surgery Department cost after service department allocations is closest to:

Definitions:

Other Revenues

Revenue generated from secondary or ancillary activities, distinct from the main business operations.

Effective Tax Rate

is the average rate at which an individual or corporation is taxed, calculated by dividing the total tax paid by the taxable income.

Fair Value

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Goodwill

Represents the intangible asset arising when a company acquires another business for more than the fair value of its net identifiable assets.

Q5: Maintenance Department costs are allocated on the

Q9: The Materials Quantity Variance for September would

Q10: The total amount of Information Technology Department

Q12: To record the incurrence of direct labor

Q27: In an n-tiered architecture, the _ is

Q30: What was Mzimba's variable overhead efficiency variance?<br>A)

Q32: When information systems projects fail, the primary

Q47: The project team review focuses on the

Q59: The cost of fixing one major bug

Q72: The most commonly used approach to delivering