Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

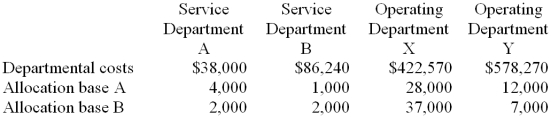

-Hodgin Corporation uses the direct method to allocate its two service department costs to its two operating departments. Data concerning those departments follow:

B.

Required:

Allocate the service department costs to the operating departments using the direct method.

Service Department A costs are allocated on the basis of allocation base A and Service Department B costs are allocated on the basis of allocation base

Definitions:

Accumulated Depreciation

The cumulative sum of depreciation costs charged to a fixed asset from the time of its purchase.

Gain or Loss

The financial result of disposing or selling an asset or investment, measured by the difference between the sale price and the asset's book value.

Equipment

Tangible assets used in the operation of a business to produce goods or provide services, such as machinery, computers, or tools.

Double-declining-balance

An accelerated depreciation method that calculates depreciation at twice the rate of the straight-line method.

Q5: When computing the net present value of

Q5: If the company bases its predetermined overhead

Q31: For performance evaluation purposes, the fixed costs

Q41: Goffinet Consultancy uses the direct method to

Q56: System tests are conducted by the systems

Q62: There are two basic strategies to motivating

Q65: If the standard hours allowed for the

Q67: Capul Company uses the FIFO method in

Q68: Revisions to the management policies and factors

Q86: A company has a standard cost system