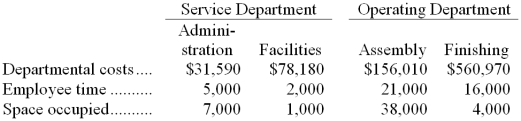

Taketa Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Administration and Facilities, and two operating departments, Assembly and Finishing.

Administration Department costs are allocated first on the basis of employee time and Facilities Department costs are allocated second on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Definitions:

Compensating Differentials

Wage differentials that compensate workers for the job attributes, such as difficulty or undesirable conditions.

Salary

Regular payment from an employer to an employee, typically expressed on an annual basis but paid monthly or biweekly.

Educational Background

The formal training and education an individual has received, including degrees, certifications, and school attendance.

Efficiency Wage

A theory stating that higher wages lead to greater efficiency and productivity by increasing worker morale, reducing turnover, and attracting more skilled employees.

Q1: Becky's employer offers fringe benefits that cost

Q6: Training should focus on everything the new

Q7: The Institute of Management Accountants' Statement of

Q11: Bill Harris works on the assembly line

Q26: Nichnols Corporation's marketing manager believes that every

Q30: What was Mzimba's variable overhead efficiency variance?<br>A)

Q32: The training delivery method that is most

Q32: When information systems projects fail, the primary

Q55: The following inventory balances relate to Bharath

Q64: Which of the following is the most